Student debt has obviously forced some number of young adults to either delay or give up on homeownership. But how many, exactly? A group of economists from the Federal Reserve Board have taken a stab at answering that question, and come up with a number that is noteworthy even if some might find it surprisingly low.

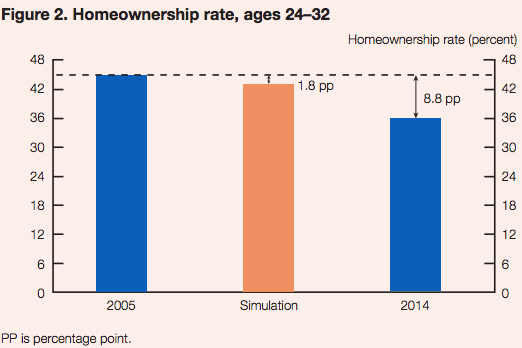

Between 2005 and 2014, the share of young adults who owned a house fell by almost 9 percentage points, more than double the drop seen among Americans overall. The Fed team’s upcoming paper, summarized in a new research note, concludes that just 2 percentage points of that decline were due to rising student debt levels—meaning that college loans locked somewhere over 400,000 individuals out of home ownership that year.

That’s not a small number. But it’s a bit below what you might expect, given the generationally important role student debt has played in Millennials’ financial lives.

The way the authors arrive at their conclusion is a bit complicated. Using credit and education data on Americans who were between the ages of 24 and 32 in 2005, they create a model estimating the impact of student debt on the probability that an individual would own a home.

They then estimate what the home ownership of young adults in 2005 would have been if they had the same student debt load as Millennials in 2014. The paper concludes that it would have been almost 2 percentage points lower.

The authors note that there may be some limitations to their study. Their data, for instance, is based on young Americans in 2005 who were applying for mortgages in a much looser credit environment than exists today. Pretty much all you needed to get a home loan during the housing bubble was half a pulse and one good hand to sign the bank docs. Today, lenders are more careful, and its possible that just having student debt, or having a delinquency or default on your credit record, may be a much bigger hurdle to homeownership then it was 14 years ago. If so, the authors are likely underestimating how much growth of college debt has hampered the ability of people in their twenties and early thirties to buy houses.

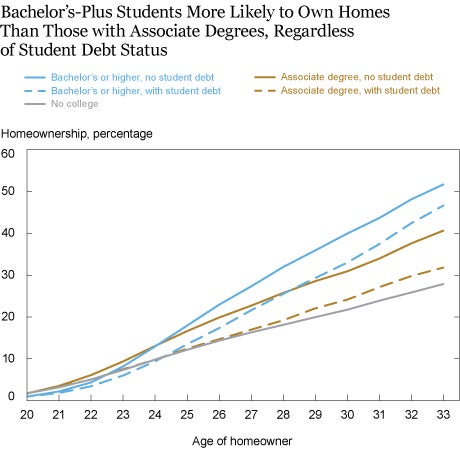

It’s also worth being clear that Americans who have bachelor’s degrees are, overall, more likely to own a house than Americans who don’t , whether or not they also have student debt. The issue is that college graduates without education loans are more likely to be homeowners than college graduates who are stuck paying off a stafford balance, as shown in this 2017 graph from the Federal Reserve Bank of New York.

So what’s the take-away? If you read the Fed’s results very literally, they suggest that while student debt has been a drag on Millennials’ ability to start buying houses, it’s not even close to the main issue deterring them from getting a foothold in the real estate market. Read a bit more loosely, though, you could say that, even if you use some very conservative assumptions about how student debt affects the ability of today’s young adults to get a mortgage, it still seems to be dragging down their homeownership rate. Either way you look at the results, they once again confirm that the price of education is costing a large group of young people the ability to start building wealth.