Credit cards are a trap. They’re easy to use, but difficult to pay. When you inevitably forget to pay your bill on time, or you spend more than you can afford, late fees and interest kick in. And suddenly, like over half of credit card carrying Americans, you’re in serious debt.

So why not just give up cards altogether? Unfortunately, when you’re young and hope to buy that first house or car with a fair interest rate, a credit card is a necessary evil for building credit.

The premise is this: You sign up with Cred’s credit card and the company’s partner bank, WSFS. (Only banks can offer credit cards in the United States, which is why even companies like Apple partner with banks for their financial offerings.) If you agree to let the company’s AI manage your spending, Cred says you’ll never pay late fees or interest. In fact, the company promises its algorithms will help manage your financial life in a way that increases your credit over time, too. “We never profit off the customers themselves,” says CEO Ry Brown.

So how does the startup make money? Like all credit card companies, Cred takes a tiny piece of every transaction you make, billed to the merchant (Visa’s current rate ranges from 1.51% to 2.4%, plus $0.10, per transaction). And in the future, the company plans to offer big ticket items, like mortgages, through its service. The company also promises to never sell your data, as most banks do.

The consumer business is built in part to bring attention to Cred’s B2B business. It plans to license its its app and platform to banks and other agencies looking to update their digital tools, theoretically democratizing best practices for credit at scale.

Cred is not the only company that’s tried to rethink credit as a more transparent practice. The aforementioned Apple Card makes many costs transparent, but its adjustments are literally superficial, and require you to synthesize graphs to change your own behavior. Another card, the Do Black card, won’t stop you from getting into debt, but it will cut itself off when you hit your carbon limit. One issue is that banks aren’t really motivated to do better. Last year, one designer in the banking industry, speaking anonymously, told me of a money-saving tool they’d developed that worked to save customers money and prevent credit card debt. The project was killed when the bank proved it actually worked.

Trying the app

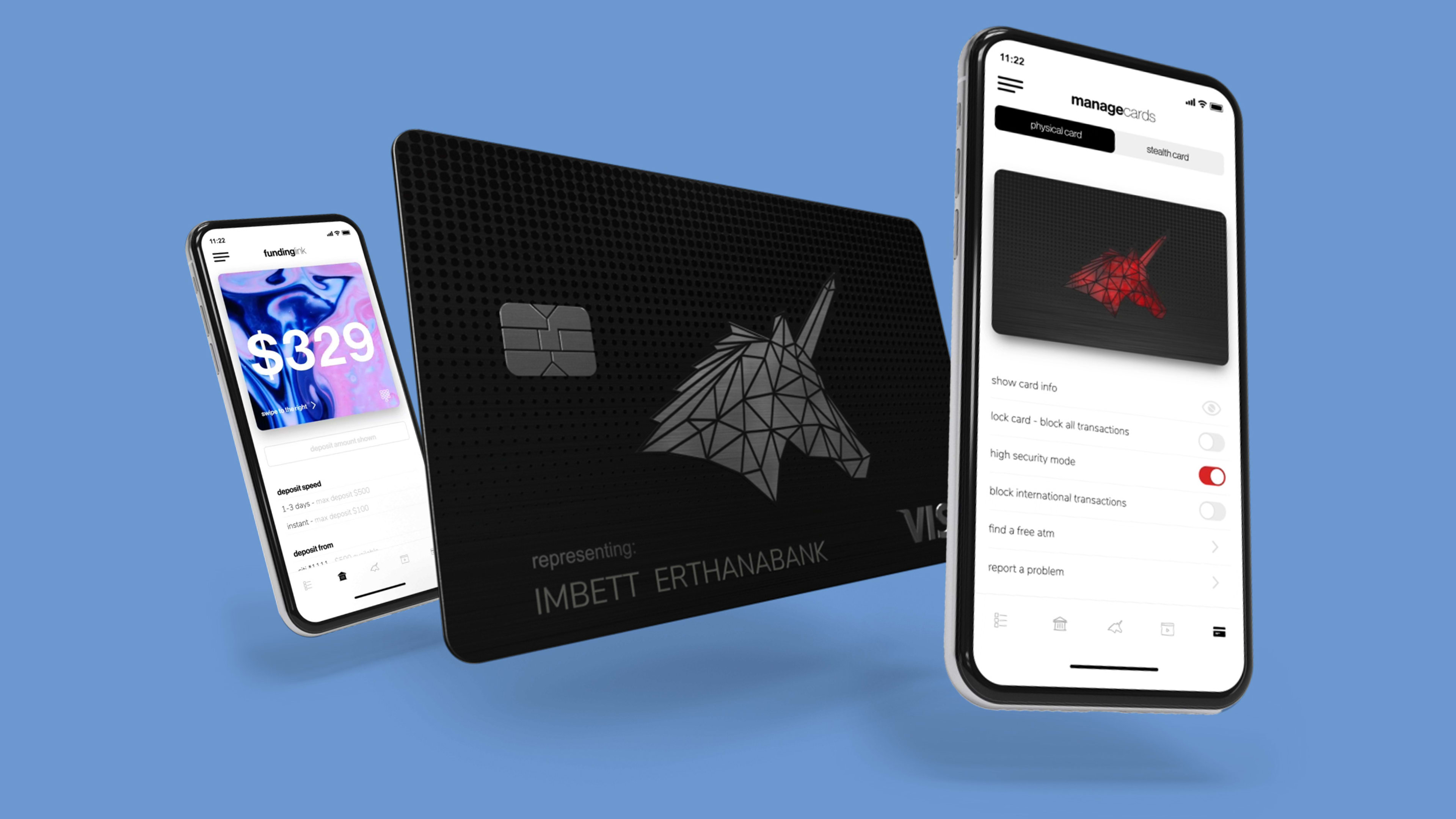

Brown walked me through a demo of Cred on Zoom. Cred sends you a physical credit card that it dubs the Unicorn Card (that’s made of metal, like the Apple Card). The key interface is in a companion app, which invites you to regularly turn on and off features of the card much like you toggle notifications on your smartphone.

When you load the app, you’re greeted with one big number: The cash you have available to spend. This isn’t all of your money, and it isn’t all of your credit. This is the money that, after calculating regular incoming expenses, Cred believes you can safely part with. It’s essentially a shorthand for your dynamic wealth; without calculating paychecks and car payments, you can know whether you’re able to afford that new pair of Space Hippies. Or maybe just lunch at Chipotle.

[Image: Cred]As you buy items on your credit card, Cred will automatically pay them off from your bank account—not instantly (that way, you can still build credit) and not necessarily at the end of the month (that way you don’t float too much debt at any given time, which can also hurt your credit). Even if you autopay your credit card monthly, Cred’s AI can, in theory, do better.

If you play by Cred’s rules, the company promises you’ll never pay interest or late fees on your credit card. Furthermore, if it calculates your bills incorrectly, and you end up buying the Space Hippies, but don’t actually have the money to pay them off, Cred will cover the cost of the shoes.

The catch: The AI is conservative. It acts like “an overbearing parent,” Brown says. He goes on: “If it sees you getting in trouble and spending more than you can, it will stop that transaction. The automation prevents you from getting into one of those situations where you’d be in trouble.” You can turn off these AI limiters in the app, but if you do, you will be facing APR charges of 17.76% (a steep, but typical, rate) if you can’t pay off your card at the end of the month.

Other features

Even if parts of Cred seem overly conservative, the system’s bigger goal is to make finances idiot-proof. Some of Cred’s best features aren’t nearly so overbearing An ’80s-inspired featured dubbed Flux Capacitor, which features a neon DeLorean on its screen, lets you see into the future of your transactions, to spot an electric bill coming up that you haven’t received yet, or access the funds of your paycheck that has yet to clear.

“Theoretically, a bank would be capable of knowing on Wednesday that an electric company will charge you Friday,” Brown says. “And they let you spend the money and over-withdraw, and your lights are off. We don’t.”

Another set of options lets you create burner credit card numbers, attached to your main account. With the tap of a button, you can create a “stealth card” to use for transactions you might consider high risk. Since its number will self-destruct over time, you can also just use that number for free trials you sign up for from various media services to avoid getting autobilled when you forget to cancel.

Another option dubbed “Friend or Foe” lets you mark businesses as trusted or not. And so if something like a gym keeps charging you, even after you’ve canceled your membership, setting it to foe will stop the payments as they come in. Could you do that with an ordinary card? Sure, but it probably involves calling a 1-800 number, going on hold, and wishing you’d spent your lunch break another way. With Cred, it’s a tap.

[Image: Cred]Not every part of Cred’s app is essential. During my limited glance, I thought it seemed over-designed in some ways. For instance, when you see your available funds, the backdrop is one of several documentaries that Cred filmed in house (the one I saw was of fishermen). Another feature will turn your financial notifications into haikus. Some may find that funny, but I imagine it getting cloying pretty quickly. It’s easy to see what Brown is going for with these decisions: They are meant to signal to customers that Cred’s approach to innovation is different from that of existing banks.

“In fintech, for some reason, design is an afterthought, they build it one time and never touch it again,” says Brown. “We want to run it like a tech company, like Adobe or Gsuite. It doesn’t change once a decade; it changes every week.” As such, Brown teases a backlog of features that will come to Cred over the months after it launches to keep the service feeling fresh.

Cred’s promises seem almost impossibly ambitious: To manage your financial life perfectly, for free. But Brown insists that this is just good business in the lucrative world of credit cards and banking.

“By addressing consumer needs, there’s plenty of money going around. The only reason for charging fees truly is greed,” says Brown. “If you see a small outfit like us is able to build features that give people the power to truly take control [of finances]…and big banks have not, it becomes a question more of intent than ability.” Given that Cred claims to be in talks with banks to license its platform—banks that profit off the exact fees Cred is eliminating—it will be an interesting capitalistic experiment to see if any banks actually do.

Cred is opening to beta customers today, and you can sign up here. For now, you will need to sign up for its Unicorn Card to participate. But in the future, Cred plans to support any major credit card you might have.

Recognize your brand’s excellence by applying to this year’s Brands That Matter Awards before the early-rate deadline, May 3.